It also means that the corporation can own assets, sue or be sued, and borrow money. Most states require the owners to file articles of incorporation with the state and then issue stock to the company’s shareholders. The shareholders elect a board of directors in an annual meeting. There are several types of corporations, including C corporations, S corporations, B corporations, closed corporations and nonprofit corporations. Some alternatives to corporations are sole proprietorships, partnerships, LLCs and cooperatives. You must follow your state’s legal requirements to become a corporation.

- There are also very considerable tax and liability considerations to be had based on the business structure chosen.

- Overall, corporations are more difficult to establish and result in more costs for the initial owners.

- Corporations can be created in nearly all countries in the world and are usually identified as such by the use of terms such as «Inc.» or «Corp.» in their names.

- You will likely need a lot of startup capital to get a corporation running, in addition to paying the filing charges, ongoing fees and larger taxes.

- As discussed above, corporations create limited liability for the shareholders.

- Small businesses often operate under a single-owner structure where one person calls all of the shots.

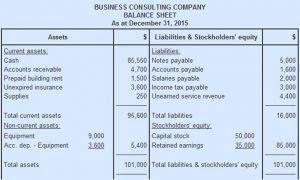

An Example of Corporation Advantages

Taking the time to incorporate suggests that the products or services https://www.bookstime.com/articles/financial-statements are legitimate and ready to provide a return over time. If you are passionate about owning and operating your business, forming a corporation is usually a poor choice. Individuals cannot personally own a corporation, as these entities are separate from their owners.

Typical Corporation Organization Chart

In other situations, the owners of a small corporation may raise capital with the help of venture capitalists. A venture capitalist is an individual or group of individuals who what is one advantage of a corporation? provide capital to growing and emerging firms. For smaller companies, the limited liability feature of a corporation may be a disadvantage in raising capital. Due to this feature, creditors have claims against only the assets of a corporation.

Pros of Forming a Corporation

- This double taxation can be avoided if your corporation is able to file as an S corporation.

- A corporation has certain characteristics that give it a number of advantages over other forms of business organizations.

- Additionally, there are legal requirements and annual documentation that must be submitted.

- Discover why the benefits of incorporation can outweigh any downsides.

Outside members are individuals who are not otherwise employed by the company and thus are independent of senior management. Immediately after the corporation’s charter is issued, the shareholders must organize the firm in order to conduct future business. Because they are considered to have future benefits, they are capitalized and are referred to as organization costs. The procedures to form a corporation and subsequently to conduct business are a function of state law, and as you might expect, all states have somewhat different laws.

What does it mean to incorporate your business?

- Owning shares can result in equity increases and dividend payments that allow for profits.

- In most cases, this person is the Chief Executive Officer (CEO) and/or President though there can be other positions as well such as Vice-President or Chief Operations Officer.

- If you operate a sole proprietorship, then the business disappears the moment you decide to stop operating.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- Because of the impact on your business and personal life, it’s important to weigh the pros and cons of forming a corporation.

- The only restriction is on S-corp ownership because of the pass-through income stipulation provided for under the current tax laws.

- If you operate as an S corp, your business will not need to pay corporate income tax.

The advantages are that they are limited liability businesses, they are considered separate entities, and their ownership is easily transferrable. Furthermore, they can benefit from management expertise, https://www.facebook.com/BooksTimeInc/ they have unlimited potential to grow and they are easy to invest in. This means earnings made by shareholders through corporations are subject to double taxation. Corporations are also considered separate entities from their shareholders.

Advantages of S Corporations

However, LLCs are often a better option when there is just one owner. They can even elect for S Corp taxation if it’s advantageous to them. If a business doesn’t need to sell stock, an LLC can be a great option. It offers legal protection, but has pass-through taxation, meaning earnings are only taxed once.